From NetEase:

Foreign media says China at the front of global property market growth

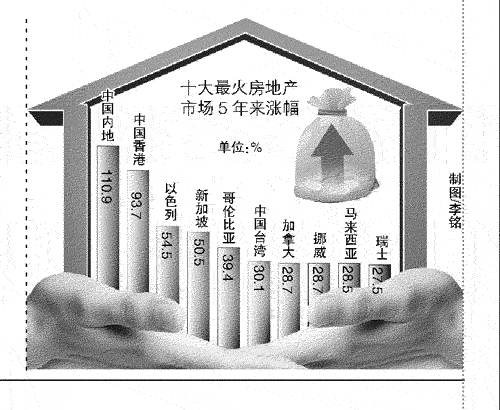

Compared with global 5-year housing prices, China has grown the fiercest, rising 110.9%, with Beijing and Shanghai the highest and Hong Kong second-highest

China is the hottest global real estate market

Foreign media recently ranked the top 10 hottest real estate markets in the world, with mainland China ranked first, with a 110.9% 5-year year increase in prices.

The report says that global property prices only rose 0.5% since last year, making many people forget this once highly speculated market. However, looking at the past 5-year growth data, the growth of housing prices remains “unable to be underestimated”, while the top ten hottest housing markets in the world have even more impressive growth.

● China’s “Two Shores and Three Territories” [refers to mainland China, Taiwan, and Hong Kong/Macau] make the hottest housing market list, mainland grows 110.9%

The ranking this time is for 5-year housing price increases, from the fourth quarter of 2006 to the fourth quarter of 2011. The report says these 5-year housing prices basically reflect the main housing price trends of various countries and regions.

Asia accounts for the majority of the top 10 hottest real estate markets, with the rise of mainland China housing prices at the top of the list. Furthermore, Hong Kong, Singapore, and Taipei, Taiwan all on the list.

The report says Singapore is the city with the most expensive real estate in South East Asia, having risen 50.5% over the past 5 years. The real estate prices for the most expensive areas rose to 25,600 USD per square meter (approximately 160,000 RMB).

Amongst this time’s rankings, mainland China occupied the top spots. The report says that along with China’s rapid rise to the world’s second largest economy, the housing prices of its major cities Beijing and Shanghai have sharply risen over 110% over the past 5 years. Amongst them, in the fourth quarter of 2011, housing prices in Shanghai’s prime areas reached 19,400 USD per square meter (approximately 120,000 RMB), with Beijing also reaching 17,400 USD per square meter (approximately 110,000 RMB).

Ranked second on the list was Hong Kong’s housing prices, which have rose 93.7% over the past 5 years, with asking prices of 47,500 USD per square meter (approximately 300,000 RMB) in prime locations.

● Expert interpretations

Fast increasing GDP has pushed up housing prices

Real estate commentator Niu Dao expressed in an interview with Legal Evening Newspaper that the rise of housing prices is related to the growth of the economy during the same period, that in developing countries and countries with fast-growing GDPs, housing prices will also grow fiercely. Niu Dao said that in fact the rise in housing prices is a result of rising per capita income and per capita purchasing power.

University of International Business and Economics International Investment Research Center Director Feng Pengcheng said that during fast GDP growth, the local population’s demand for housing also increases, ultimately pushing up housing prices.

With regards to our country’s real estate market, Niu Dao expressed that the past 10 years have also seen huge increases in China’s housing prices. Our country’s housing prices are currently in a declining trend, but the ultimate decline in housing prices will still take 5-8 years of adjustment.

Comments from NetEase:

candtrae [网易加拿大网友]:

After reading this report, Brother’s [referring to self] felt a spontaneous sense of blessing and good fortune. 7 years ago, Brother resolved to leave a certain major Chinese city for a country with fresh air, beautiful environment, and where all prices like food, gasoline, car, and housing are all much cheaper.

郭嘉已沉睡 [网易广东省网友]:

The entire country’s people welcome the rise of housing prices! Only rising a little over 100%, just which city grew so little?

泪光玲珑 [网易加拿大网友]:

Every time after I finish reading news on NetEase, I encouraged myself to work hard to emigrate abroad and now I’ve succeeded. Thank you NetEase!

网易香港网友:

Hearty congratulations. Our motherland has again gotten first place.

Hearty congratulations. The happiness index has once again increased.

世界强国领导人金三代 [网易德国网友]:

Why is the foreign media so meddlesome!?

Must not interfere with internal affairs!

网易香港网友:

The ordinary common people everywhere express that housing prices are not high and are all affordable. If housing prices increase, they’d be even happier.

网易广东省网友:

Our country is a major economic power, so really, this little accomplishment doesn’t mean much.

网易北京市网友:

Can I use profanity?

网易香港网友:

Mother-in-law economy [the demand that a husband for one’s daughter own a house], rigid requirements [demands by women that suitors own a house], GDP growth, happiness index growth… All reasons for the rise in housing prices.

网易广东省广州市荔湾区网友:

Sofa.

Just thinking about housing makes me lose sleep…

[polldaddy poll=6191025]

132 Comments

Leave a Reply